Access to full FDIC insurance coverage on account balances up to $175M. Your account funds are deposited among member banks to ensure full FDIC coverage, while providing a simple, safe and seamless experience.

Secure your funds easily with Insured Cash Sweep®

Simple and seamless

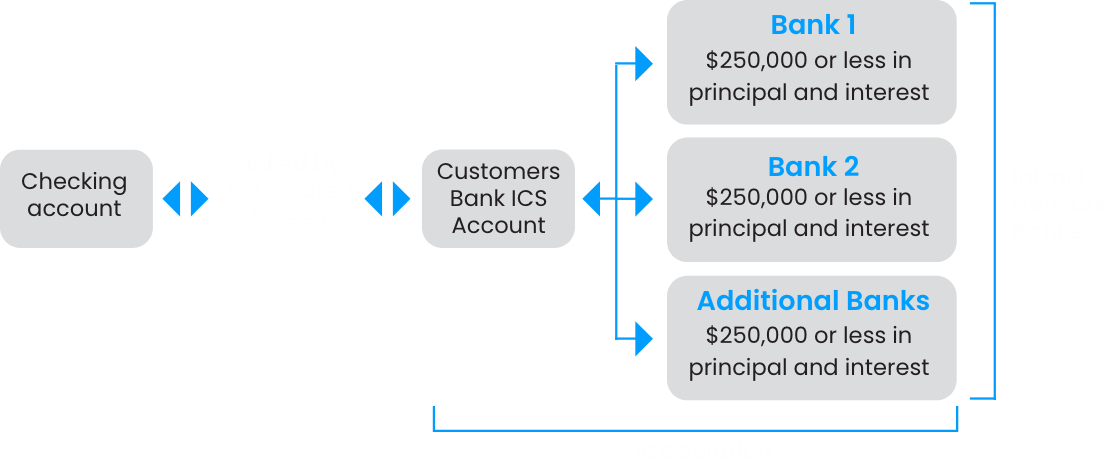

With the ICS service, you will have access to FDIC insurance above the $250,000. limit through a single bank relationship. No need open accounts at different banks or read multiple bank statements. Funds are deposited into interest bearing money markets accounts so they remain liquid and fully insured by the FDIC.

Safe

ICS funds are eligible for expanded multi-million dollar FDIC insurance, protection that is backed by the full faith and credit of the federal government.

Easily access funds

With ICS, maintain access to your funds placed in demand deposit accounts or money market accounts.

Streamlined

Working directly with Customers Bank, you will receive one monthly statement from us summarizing your account activity and balances. For those accustomed to collateralization, reduce the need to track collateral on an ongoing basis.

Get in touch.

If you have questions or want to talk about Insured Cash Sweep®, we’re here to help.

Contact usMinimum participation size is $1,000,000.

When deposited funds are exchanged on a dollar-for-dollar basis with other banks in the ICS Network, Customers Bank as a participating institution can use the full amount of a deposit placed through ICS for lending. Alternatively, with a depositor’s consent to certain types of ICS transactions, the Bank may choose to receive fee income instead of deposits from other banks.

Placement of funds through the ICS service is subject to the terms, conditions and disclosures in the service agreements, including the Deposit Placement Agreement (“DPA”). Limits and customer eligibility criteria apply. Although funds are placed at destination banks in amounts that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”), a depositor’s balances at Customers Bank may exceed the SMDIA (e.g., before ICS settlement for a deposit or after ICS settlement for a withdrawal). As stated in the DPA, the depositor is responsible for making any necessary arrangements to protect such balances consistent with applicable law. If the depositor is subject to restrictions on placement of its funds, the depositor is responsible for determining whether its use of ICS satisfies those restrictions. ICS and Insured Cash Sweep are registered service marks of IntraFi Network.

Banking products and services are offered by Customers Bank, Member FDIC and Equal Housing Lender

ICS funds are eligible for expanded, multimillion-dollar FDIC insurance of up to $135 million per tax ID for ICS demand and up to $100 million per tax ID for ICS savings. Total available ICS insurance (assuming a client opens both ICS Demand and ICS Savings) is $175 million per tax ID.